Our Awesome Clients

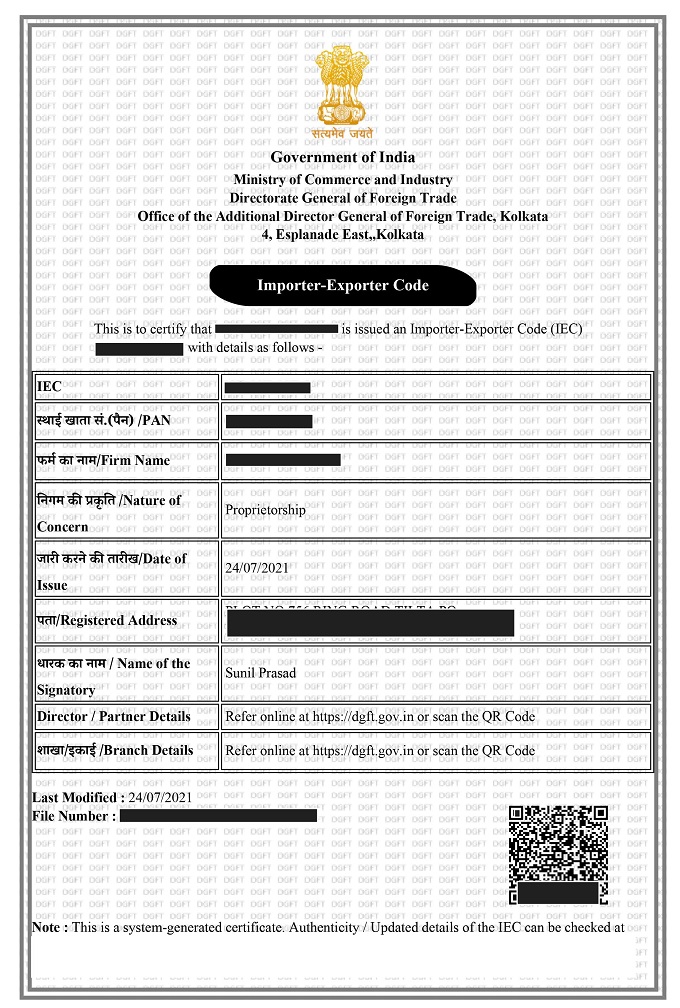

An Importer Exporter Code (IEC) is a key business identification number which is mandatory for export from India or import to India. No export or import shall be made by any person without obtaining IEC. IEC shall not be necessary except when the service provider is taking benefits under the Foreign Trade Policy. An individual or business entity needs a 10 digit code to import or export products or service. This code is known as Importer and Exporter code or IEC and it is issues by DGET, Ministry of Commerce and Industries, Govt of India.

Yes, as per the government rules, Importer Exporter code is mandatory if you are in Import and export business.

IEC Fee details:

Professional Fee: INR 2500

Govt Fee: INR 500

Total Fee: INR 3000

Any business who are involved in Import & Export business must / can apply for IEC

After submitting all the required details it will take maximum of 72 hours to get the IEC registration.